Payments to Students Guidelines & Procedures - Entire Document

Why Does it Matter How We Pay a Student?

When paying monies to a student, it is critical to ensure the payment has been classified correctly in order to satisfy compliance requirements with Internal Revenue Service, federal financial aid regulations, CSU policies, and donor intent. While CSUSB strives to comply with intent of donors when administering funds to students on their behalf, donor intent, no matter how specific or strongly worded, may not supersede the university’s obligation to meet federal and state financial aid rules, IRS regulations, Fair Labor Standards Act, or other CSU rules or guidelines.

At CSUSB, there are four categories of payments to students:

Payment Categories

Purpose of Guidelines and Procedures

Best Interest of Student

By complying with all relevant rules, regulations, and policies, CSUSB will ensure payments will be made in the most appropriate manner and avoid any unintended negative financial impacts for our students (ex: student unnecessarily receives an IRS Form 1099).

Compliance

Ensure that all procedures that support the administering of payments to students comply with federal financial aid rules, IRS regulations, and CSU/CSUSB policies (such as employment).

Accountability

Ensure that all appropriate parties at CSUSB involved in administering payments to students:

- Are aware of, and understand, the Payments to Students (and related) policies

- Fully understand their responsibilities and can fulfill their duties in compliance with federal financial aid rules, IRS regulations, and CSU/CSUSB policies

Responsibilities

Departments, Organizations, or Individuals Making Payments to Students

While all parties involved in administering payments to students share responsibility, the process ultimately begins with the payer making the proper determination as to the classification of payment.

It is the responsibility of each awarding department to monitor expenditures from their accounts, including funds awarded, disbursed, adjusted, or cancelled.

If funds were donated, awarded as part of a grant, or have any spending restrictions, the department selecting recipients is responsible for ensuring awards comply with donor intent (but not to supersede policy).

Recipients of payments that fall under the Financial Aid category should be made aware that their award may impact their financial aid package and must be taken into consideration when the financial aid department determines eligibility for funds from other sources, including federal loans. The Financial Aid Office has the responsibility of determining whether adjustments are necessary.

In most cases, departmental awards will not impact a student’s aid package when processed through the student information system. If other aid must be adjusted to accommodate new funds, loans will typically be reduced first. Lowering a student’s educational loan debt should be considered a positive outcome.

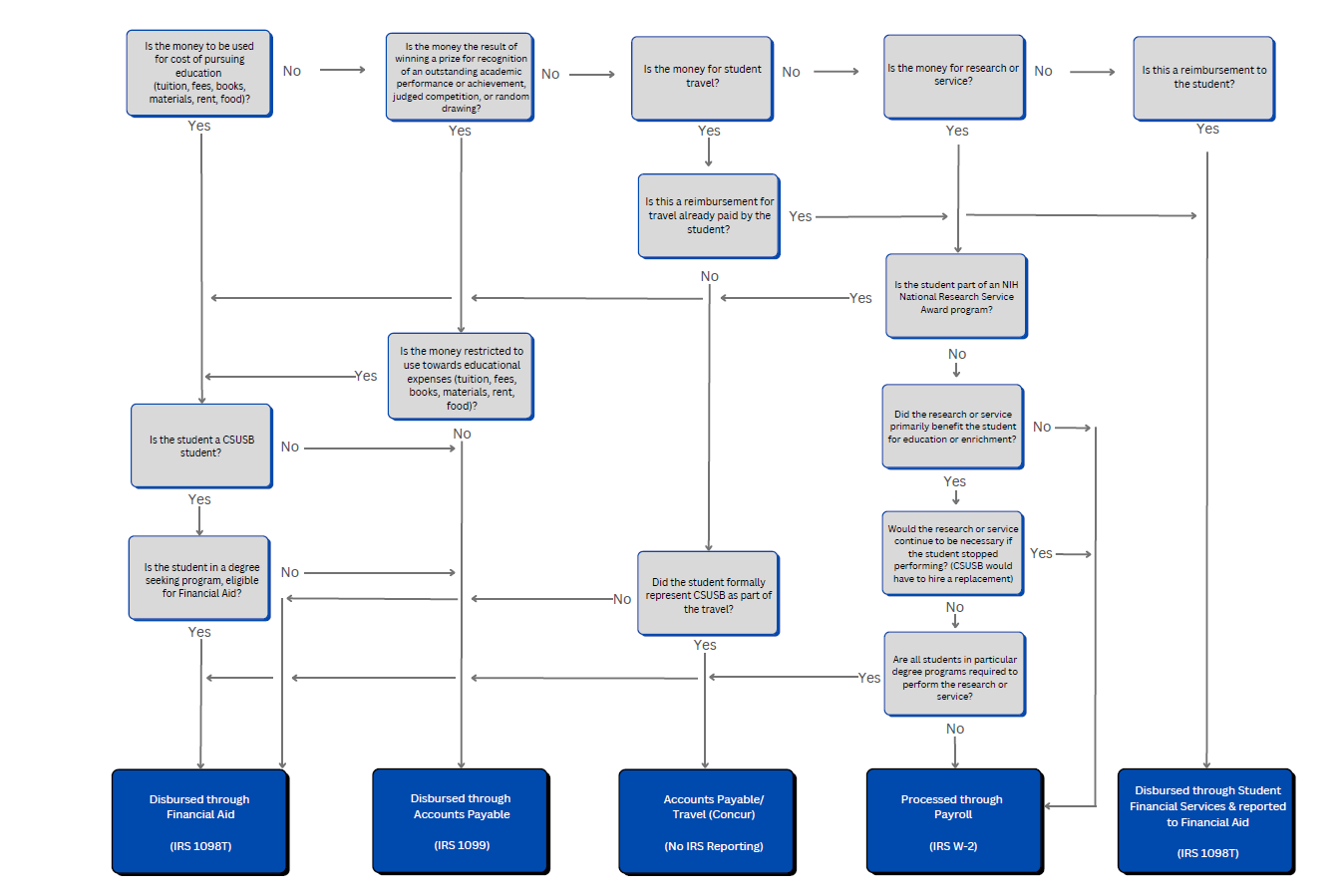

Decision Tree

Decision Tree Updated 3-12-25.pdf

The entire Payments to Students Guidelines & Procedures document contains all relevant information necessary for departments to identify the proper classification of each payment to students.