VITA Volunteer Training

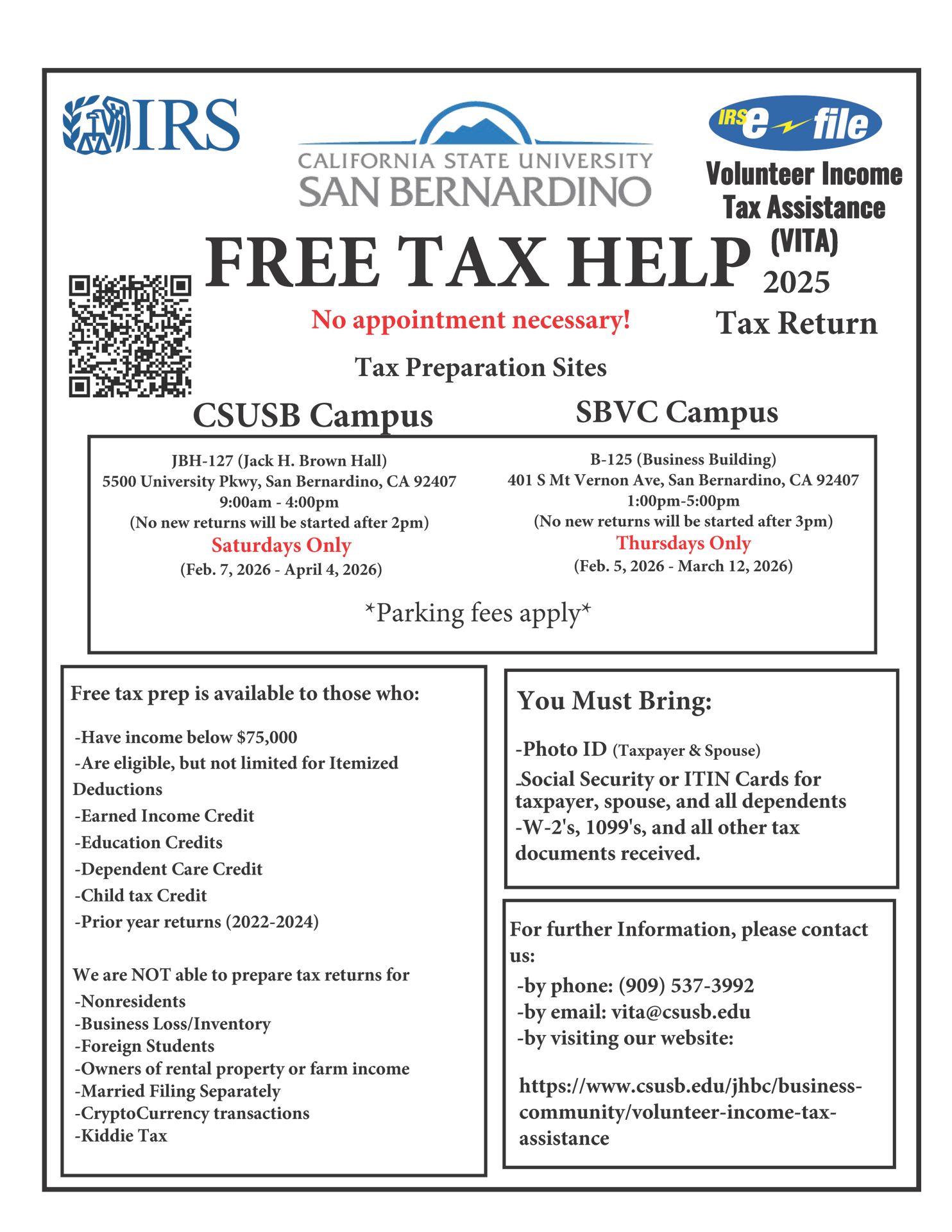

We will be providing VITA services at CSUSB for the Spring of 2026 filing season. Services will be offered on Saturdays from 9:00 am to 4:00 pm (No new returns started after 2:00pm) starting February 7, 2026 and ending April 4, 2026. Services will be held on campus in the Jack Brown Hall building Room 127. If interested in volunteering, please apply to the VITA program. For any questions, please send an email to vita@csusb.edu, and a VITA team member will respond to you. Training for the upcoming VITA season will be held at the end of January 2026.

What is VITA?

The VITA program provides free income tax preparation to low-income individuals and families throughout the Inland Empire during the tax return season. In addition, services for low income senior citizens, non-English speakers, and the disabled are provided.

For more information, Please read our Frequently Asked Questions Section or email us (vita@csusb.edu)

To locate an open VITA site near you, please use the VITA locator Toll or call 800-906-9887. For more information please go to www.IRS.gov and check their list of sites.