Alan Llavore | Office of Marketing and Communications | (909) 537-5007 | allavore@csusb.edu

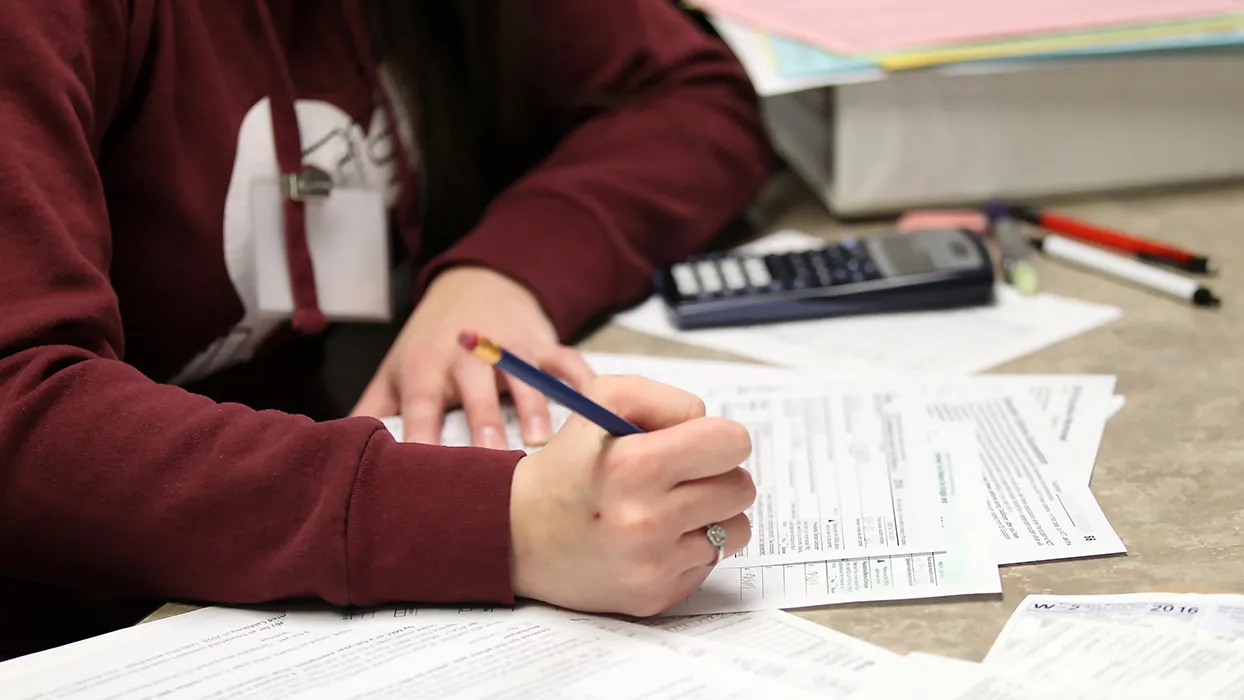

Each spring, Cal State San Bernardino’s Volunteer Income Tax Assistance (VITA) program offers vital support to the community while providing students with valuable, hands-on experience. Staffed by trained volunteers — most of them CSUSB accounting and finance students — the program delivers free, IRS-certified tax preparation services to individuals and families with low to moderate incomes, people with disabilities, and those with limited English proficiency.

During the most recent tax season, VITA reinforced its role as a community resource by preparing more than 200 tax returns. As a result, clients received $179,386 in federal refunds and $48,505 in state refunds. In addition, student volunteers and faculty coordinators assisted clients in claiming important tax credits, including:

• $19,451 in Federal Earned Income Credit (EIC)

• $144,638 in Federal Education Credits

• $9,028 in Federal Child Tax Credit

• $10,449 in State Earned Income Credit

Beyond the numbers, the program serves as a dynamic learning environment for student volunteers. Through their work, they gain practical knowledge in tax law, client relations and professional ethics — often marking their first opportunity to apply classroom lessons to real-world situations.