Relocation Policy - CSUSB Management Employees

RESPONSIBLE DEPARTMENT: Human Resources, 909/537-5138

California State University, San Bernardino's policy is to provide a relocation bonus to assist with anticipated moving expenses, when necessary, to new employees when authorized by the President or the appropriate Vice President. The relocation bonus amount must be listed in the appointment letter. Provision for relocation bonus must be agreed upon at the appointment and stipulated in the appointment letter.

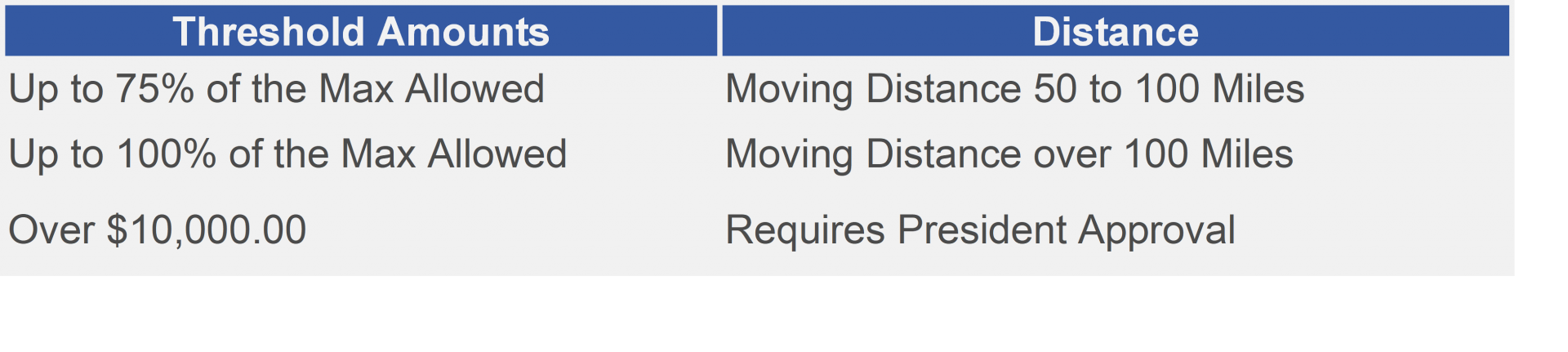

A relocation bonus will be limited to the available budget and the tables below. The Vice Presidents may approve a relocation bonus that falls below $10,000.00 Presidential approval is required for a relocation bonus of $10,000.00 or above. The university official extending the relocation bonus shall be responsible for ensuring that funds to pay relocation expenses are available and budgeted for this purpose prior to extending an offer.

Positions available for a relocation bonus are as follows: Administrators II, III, and IV groups. A relocation bonus is considered part of the total compensation consideration when an offer of employment is made.

| Administrator Level | Maximum Allowed |

|---|---|

| IV | $10,000.00 |

|

III |

7,500.00 |

| II | 2,500.00 |

| I |

- 0 - |

Because of the variance that occurs when employees relocate from different geographical areas, the costs for relocation will differ.

CSUSB provides a recruitment bonus to help cover some of the relocation costs.

- The Recruitment bonus is considered taxable income.

- Recruitment bonuses are one-time payments issued after the employee has started their position.

- Employees are not required to submit receipts.

- The amount of the approved recruitment bonus will be included in the Employment Offer Letter.

- Payment will be made to the employee through payroll and is subject to tax withholding.

Should an employee for whom relocation assistance is provided not be employed for a period of at least two years, the employee must repay CSUSB. Repayment Schedule:

- 100% if employed less than six months.

- 75% if employed at least six months, but less than 12 months.

- 50% if employed at least 12 months, but less than 18 months.

- 25% if employed at least 18 months, but less than 24 months.

Payroll Services will notify Accounting Services to issue a bill to the separated employee when the employee fails to satisfy the terms of the relocation bonus policy.

Example: An employee was approved for a $10,000 recruitment bonus. After taxes, the net amount received was $8,237; therefore, the employee was taxed $1,763. If the employee leaves after 18 months, 25% of the the recruitment bonus would be due back to the university. [$8,237 x 25% = $2,059 to be repaid]

Unexpected Exceptions

Employees whose discontinuance of university employment resulted from death, disability, or similar unexpected cause beyond the employee’s control. As determined by the appointing authority, are exempt from this repayment policy.

Not all new appointees or current CSU employees will be eligible for a Relocation Bonus. The decision by an appointing authority to offer a Relocation Bonus is discretionary and contingent upon the availability of funds. Not all new appointees or current CSU employees will be eligible for a Relocation Bonus. The decision by an appointing authority to offer a Relocation Bonus is discretionary and contingent upon the availability of funds. For specific information on special circumstances not addressed in this document, please refer to the CSU Internal Procedures Governing Payment or Reimbursement for Moving and Relocation Expenses Policy.